(This article is co-written with Evan Kimbrell and will introduce you to a basic marketing concept that you can use as a handy lens for understanding your financial models. )

What are funnels?

Yes funnels, like you “funnel” something into your mouth, or you funnel money out of your ex-husband or wife’s business – called embezzling – but with regards to financial models what am I talking about?

Well, same as in any marketing campaign we generally like to think of our progress or more specifically our acquisition of users or customers in distinct phases. Marketers usually delineate this process into phases because it allows them to see which areas need focus and it’s a kind of measuring stick for their progress.

Specifically, let’s say I’m marketing a website and I go and run some ads.

How do I measure how effective that ad campaign is?

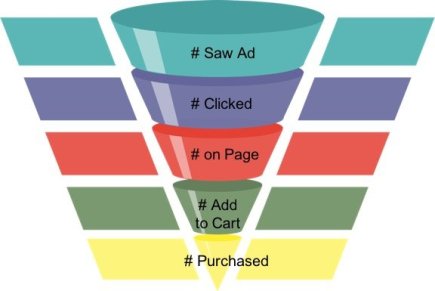

Well, you would have to look at many things. First, you’d have to look at the number of people that saw your ad, then the number that clicked it, then the number that stayed on your page and didn’t immediately leave, then the ones that maybe put an item in their cart, then finally by the number that purchase.

Some marketers go even farther and track who then refers others to buy from you. Because the number in each phase gets smaller and smaller – remember anything past that first phase of seeing your ad is going to be lower than the number of people that saw your ad because it’s a subset of that number – that means you could display this process in a shape that looks like a funnel.

Something like this:

Lots of people go into the top – often called “top funnel” by the hip marketers – and the people that make it all the way through to the end are the absolute number that buys from you, sign up, or whatever your goal is. We call that down funnel naturally.

Think in Funnels for Financial Models for Your Business

Now with a lot of different disciplines, we can gain a certain level of insight by cross-pollinating concepts. Financial modeling is no different. If you can take manufacturing concepts like economies of scale, or economics concepts like price sensitivity, or even concepts from sales such as price leverage – then you can certainly borrow the concept of funnels from marketing. And we strongly suggest you do so.

I find it useful when you begin to think of a model to keep asking yourself:

“Could I think of this as a funnel?”

In most cases, the most useful way of applying this concept is to user acquisition. You have to pay money either directly or indirectly to get customers. So it’s worth knowing which of your efforts to get them is the most effective and what their funnels look like.

How would we look at our users in a basic funnel?

So let’s say, we run Twitter. Yes, we are Jack Dorsey or whoever that other guy is.

Well, remember that Twitter is a social network and they don’t sell you anything.

In their case, they might track:

- the number of people that saw an ad or a sponsorship or a news story

- the # that went to Twitter

- the number that didn’t immediately leave

- the # that clicked signup but

abandoned the # that did finally sign up.

But since the application has more depth than that we might go farther. We might also track:

- the # of users that fill out their entire profile

then the # of users that add 20 followers- then the # that sends their first tweet

- maybe even track them by how often they come back to the app

In Twitter’s case, tracking like this would be helpful because we’re essentially tracking who ends up using it the most. They make their money off advertisements, and the more someone clicks, the more they make.

If I were financially modeling Twitter business model, I would probably make a separate tab in my Excel sheet that tracked this process. I could then pull insights like what % of my new users got to a certain point or even what the cost per user getting to that point was.

The funnel concept is beneficial because it’s a way of imagining what appears to be a flurry of customer behaviors and puts them into a linear and logical step by step process. If you acquire your customers or even have a landing page where people can sign up, you’ll probably want to track this with a funnel design.

What does a basic funnel model look like?

In a financial model, a basic funnel could look as simple as this.

In the first column, you could mark out the stage in your process, then next to it mark the total number of users that made it to that part. You can add percentages, or calculate the % decrease from each step to the other.

So when you put together the model for whatever your business may be, a Twitter like social network or even a simple lemonade stand business, ask yourself:

How do I get my customers?

Would it help to understand and visualize that process?

And then last is there any other part of my business that I could visualize like this? If I ship out a product for instance, how many products break after a week, break after two, or get returned? That’s also a funnel.

So try to think in terms of funnels. It not only helps you better visualize your process, but it can give you critical insights into how to improve and debug your process. Not sure what your funnel might look like? Google it.

No, I’m serious you can Google this stuff especially if you’re looking at an obscure industry with just a few minutes of digging.

Pro tip: Don’t search by the specific business. Not “Pet rock enthusiasts subscription model” search for “subscription business model” or “funnel for subscription business.”

What is your funnel?

Could you visualize your business in a robust financial model to help you make smarter decisions?

If you’re interested in learning how to build robust financial models for your startup business, join over 43,000 fellow students in my Financial Modeling for Startups & Small Business course, complete with fully built financial models for seven completely different types of businesses.

Leave a Reply

Want to join the discussion?Feel free to contribute!